Robo-advisors Outperform Human Investors Amid Market Crash

Monday, November 27, 2023

With advances in machine learning and artificial intelligence, robo-advisors (RAs), which automate investing by using an algorithm, are increasingly used for investment decision support.

But with this technology comes a lot of unknowns, such as how these RAs react to dramatic changes in the financial markets.

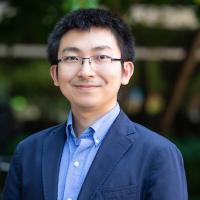

Associate Professor Mochen Yang and two co-authors studied the performance of RAs during the economic downturn caused by the COVID-19 pandemic. They found RA users experienced significantly fewer losses during the market downturn compared to human investors. Additionally, RA systems adjusted their portfolios during this time to hold less risky funds, while human investors continued to invest in the status quo and did not reduce the risk of their portfolios.

Importantly, the RA’s superior performance was not simply a continuation of its performance in a normal market; in fact, Yang found RA users to have similar portfolio returns as non-RA investors during normal markets, and the benefits of RA’s risk-reduction trading strategy only manifested during the financial crisis.

“Our work confirms the positive impacts of RAs during the financial market turmoil induced by COVID-19,” Yang says. “In the context of financial decision-making, we show that using an RA system can significantly mitigate losses for investors and that RA’s adaptivity is an important contributor to its robustness.”

To compare the performance, Yang obtained daily portfolio and transaction data of investors on an online investment platform. He matched RA users with other investors who did not use the RA with similar investor and portfolio characteristics before the market crash and then compared their portfolio returns after the crash.

Yang and his colleagues found RA investors had a 12.67 percent performance advantage, which is both statistically significant and economically meaningful. This is significant because in 2019, more than $820 billion of assets were managed by RAs, and the size of RA-managed assets is projected to have a 26 percent annual growth rate between 2020 and 2024.

Paper: "Judge me on my losers: Do robo-advisors outperform human investors during the COVID-19 financial market crash?"

Journal: Productions and Operations Management

Published: June 9, 2023