Finance 101 Series Provides Advice for Raising Capital

Friday, March 14, 2014

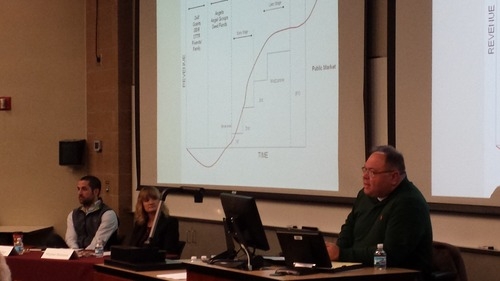

This morning, Minnesota Cup hosted the third 101 Series event at the Carlson School of Management. Investors and entrepreneurs were in attendance to review and gain more insight about the different financing that each stage of a startup requires.

The 101 Series is a string of free events hosted by the Minnesota Cup to help entrepreneurs learn more about core business functions and how they can be applied to startups. Next up in the series is Marketing 101 on Friday, April 18.

The event started with Doug Ramler of Gray Plant Mooty moderating a panel of investors - a banker and a venture capitalist.

Meghan Hormann of Wells Fargo discussed SBA loans and knowing about the options available to you. "As an entrepreneur, you have to be willing to ask for what you want," she noted. The four things that banks will look for when evaluating a business are:

- Direct industry experience

- Projected cash flows

- Personal Credit

- Collateral and outside income

Next, Ryan Broshar of Confluence Capital discussed what is involved after a deal is reached between the investor and the entrepreneur. He mentioned that is important to meet with companies often to touch base on what progress has been made since signing a deal.

The panel of entrepreneurs was up next. The panel included Nick Beste of Man Cave, Wade Gerten of 8thBridge and Christine Wheeler of Drazil Foods. In total, these three entrepreneurs, who are also past participants of the Minnesota Cup, have raised approximately $17.5 million. All three panelists explained that the most important piece of raising capital is networking.

A big thank you to the investors and entrepreneurs that participated on the panel as well as everyone who came out to the event!