Finance Department Guest Seminars

We invite you to embark on an exciting journey into the world of finance, where you'll gain access to cutting-edge knowledge, engage with industry experts, and foster invaluable connections within the finance community.

Finance Seminar Series Spring 2024

Robert Richmond

Assistant Professor of Finance - NYU

February 16th, 2024

10:30 AM - 12:00 PM

CSOM 1-143

Renee Adams

Professor of Finance - Oxford University

February 23rd, 2024

10:30 AM - 12:00 PM

CSOM 1-143

Hui Chen

Nomura Professor of Finance - MIT

March 1st, 2024

10:30 AM - 12:00 PM

CSOM 1-143

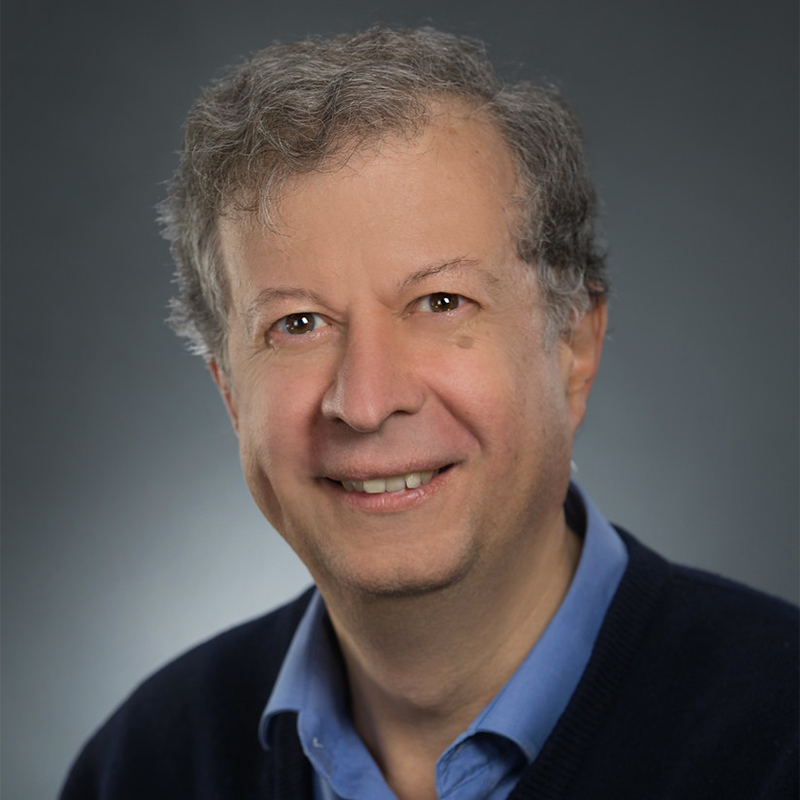

Amiyatosh Purnanandam

Michael Stark Professor of Finance - University of Michigan

March 15th, 2024

10:30 AM - 12:00 PM

CSOM 1-127

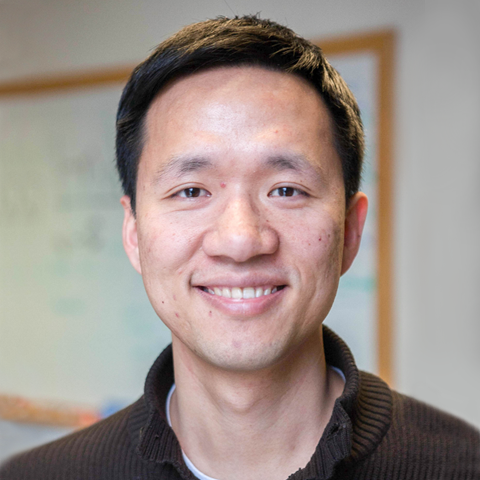

Winston Dou

Assistant Professor of Finance - University of Pennsylvania

March 29th, 2024

10:30 AM - 12:00 PM

CSOM 1-143

Tony Cookson

Professor of Finance - University of Colorado

April 5th, 2024

10:30 AM - 12:00 PM

CSOM 1-127

Max Maksimovic

William A. Longbrake Chair in Finance & Professor of Finance - University of Maryland

April 19th, 2024

10:30 AM - 12:00 PM

CSOM L-126

Vincenzo Quadrini

Professor of Finance and Business Economics - University of South Carolina

April 26th, 2024

10:30 AM - 12:00 PM

CSOM 1-127