Corporate Finance MBA Specialization

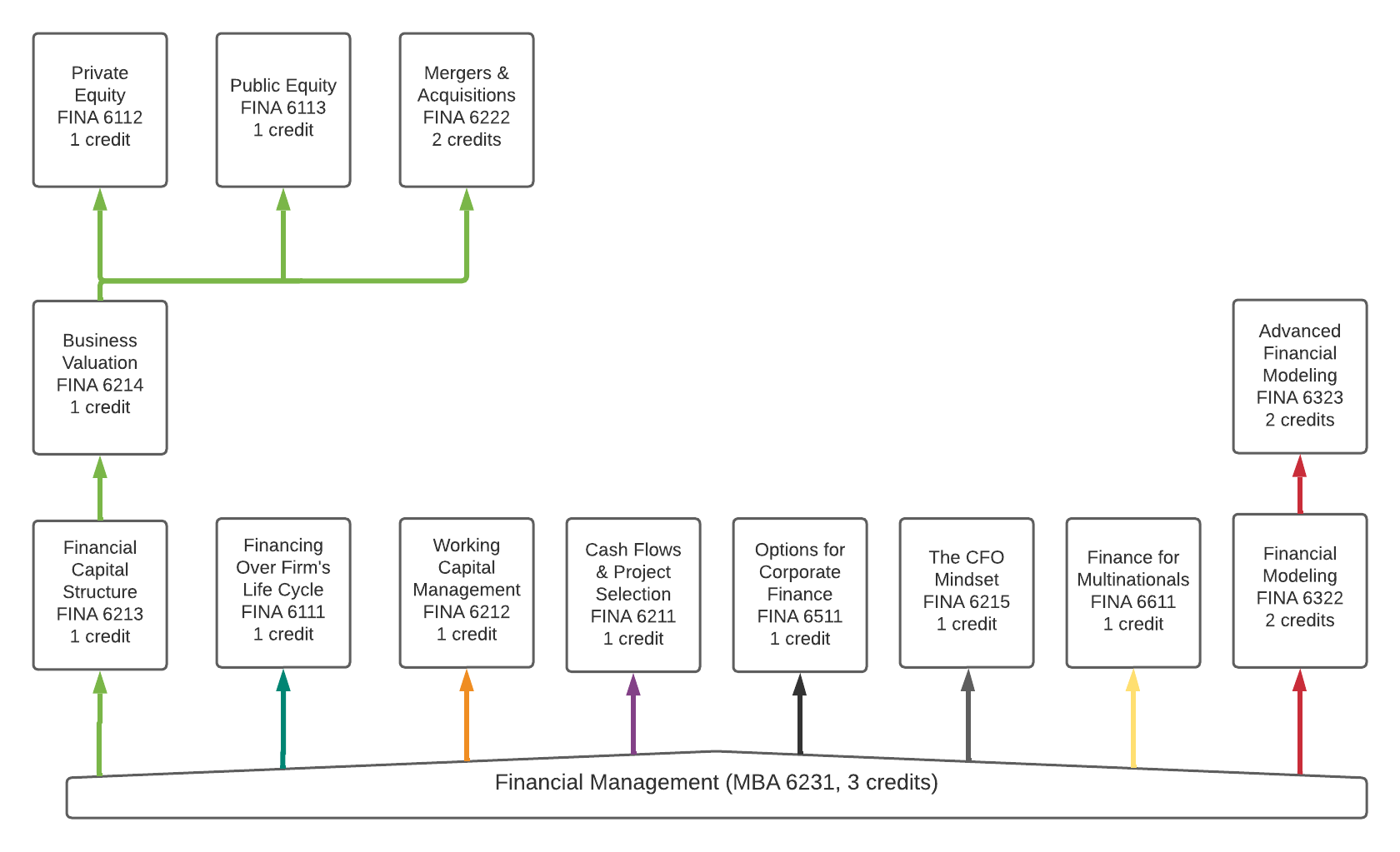

The Finance Department is excited to introduce a new curriculum of MBA corporate finance education. The goal is to provide students with more flexibility in choosing topics of interest and designing one’s own learning path. It also enhances instructor specialization. The main change is twofold. First, two existing 4-credit courses (FINA 6241, FINA 6242) are broken down to a set of 1-credit topic-based courses. Second, we add new courses on highly-demanded topics such as Working Capital Management and Private Equity. The Corporate Finance Topic Tree will give you a good idea about the overall structure of the courses and the possible learning paths.

Corporate Finance Topic Tree

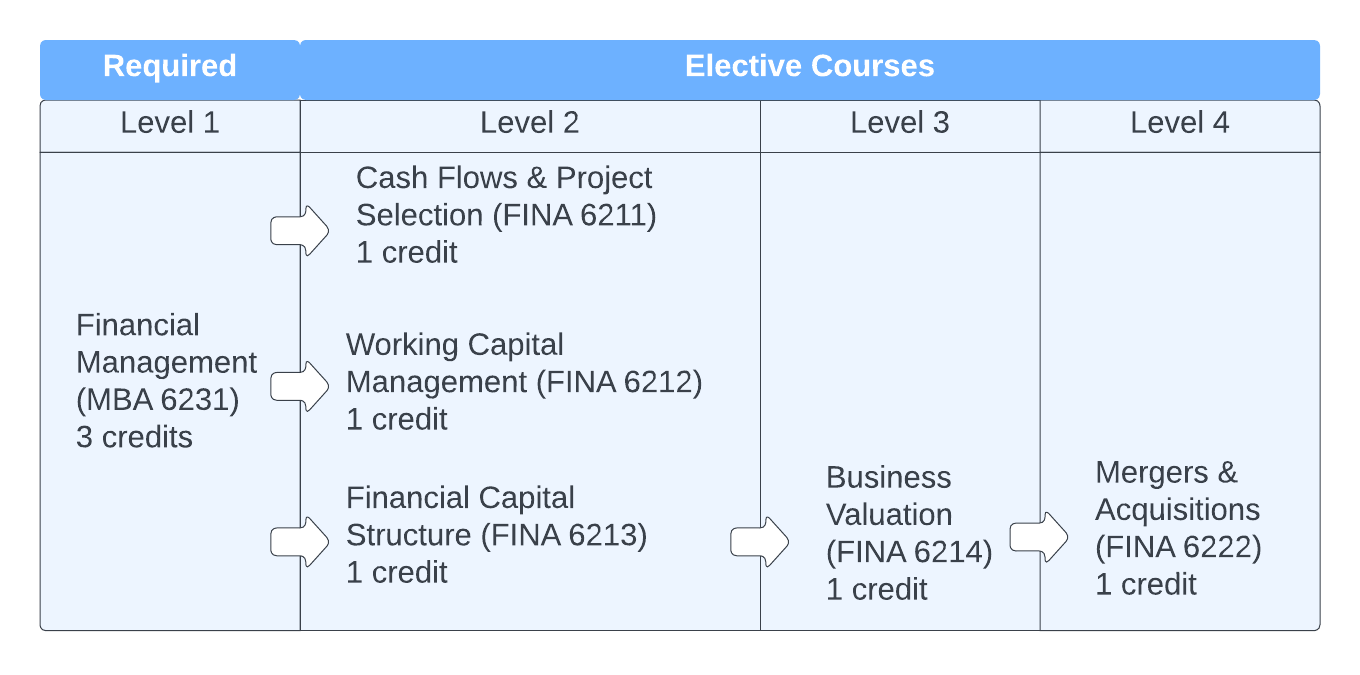

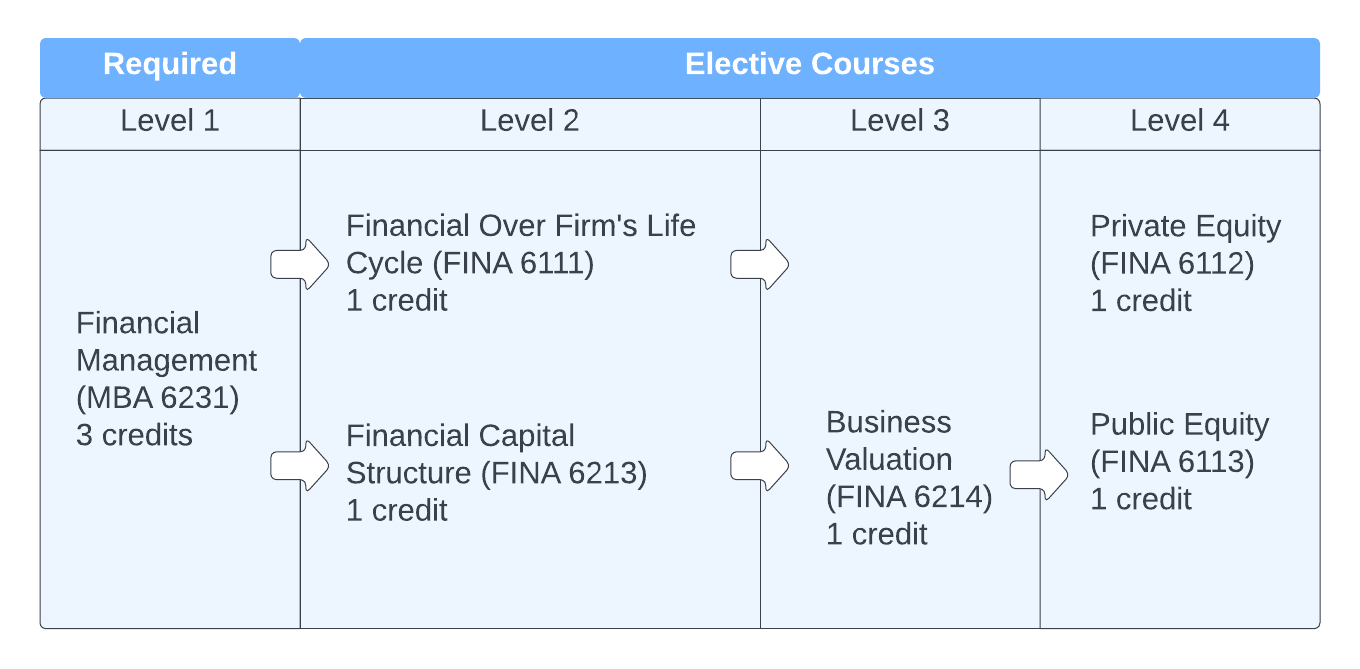

Specialization Requirements and Sample Tracks

| Required (7 credits) | Electives (at least 5 credits) |

|---|---|

| FINA 6111 Financing over Firm's Life Cycle (1 credit) FINA 6213 Financial Capital Structure (1 credit) FINA 6212 Working Capital Management (1 credit) FINA 6211 Cash Flows & Project Selection (1 credit) FINA 6241 Business Valuation (1 credit) FINA 6112 Private Equity (1 credit) FINA 6113 Public Equity (1 credit) | FINA 6222 Mergers and Acquisitions (2 credits) FINA 6121 Debt Markets, Interest Rates, and Hedging (2 credits) FINA 6611 Finance for Multinationals (1 credit) FINA 6322 Financial Modeling (2 credits) FINA 6323 Advanced Financial Modeling (2 credits) FINA 6324 Securitization Markets (2 Credits) FINA 6511 Options for Corporate Finance (1 credit) FINA 6325 Behavioral Finance (2 credits) |

| Course | Fall A1 | Fall A2 | Fall B1 | Fall B2 | Spring A1 | Spring A2 | Spring B1 | Spring B2 |

|---|---|---|---|---|---|---|---|---|

| Cash Flows and Project Selection (FINA 6211) | Monday Evening | TTh PM | Online | |||||

| Working Capital Management (FINA 6212) | Monday Evening | TTh PM | Online | |||||

| Financial Capital Structure (FINA 6213) | Wednesday Evening | Online | ||||||

| Business Valuation (FINA 6214) | Wednesday Evening | Online | Online | |||||

| Financing over a Firm’s Lifecycle (FINA 6111) | Online | TTh PM | Friday AM | |||||

| Private Equity (FINA 6112) | Wednesday Evening | |||||||

| Public Equity (FINA 6113) | Wednesday Evening & Friday AM | |||||||

| Options for Corporate Finance (FINA 6511) | TTh PM | |||||||

| Finance for Multinationals (FINA 6611) | Will be held in spring | Will be held in spring |

If the table cell is blank, the course is not offered in that time frame

New Course Descriptions and Prerequisites

Prerequisite: MBA 6231

Managers are judged on their ability to select value-added projects; this is also one of the drivers of business value. This course will explore the idea of ranking and selecting the best projects. This will be accomplished through a study of cash flows and ranking metrics, including payback, internal rate of return and net present value.

Prerequisite: MBA 6231

Cash management is a major factor in the success or failure of a business. Companies often find themselves short on cash even in a time of profitability. Being able to manage a business through the cash cycle is a key factor in business success. This course will explore current issues and best practices for working capital management.

Prerequisites: MBA 6231

Description: This course focuses on one of the most fundamental corporate finance decisions, the determination of a firm’s financial capital structure, and its impact on firm risk, cost of capital, and firm value. The course also studies corporate bankruptcy and reorganization.

Prerequisites: MBA 6231, FINA 6213

Description: Valuation is at the very core of finance. Valuation is about figuring out what we think an asset is worth to us, while pricing determines how much we pay for the asset. The two are not necessarily the same. This course introduces various methods for the valuation of a business or the equity of the business.

Prerequisite: MBA 6231

All companies—from small startups to large public companies—require funding in order to operate. This course provides an overview of the various sources of financing that a company can access throughout the different stages of its life, including: debt and equity financing, Venture Capital, Private Equity, Initial Public Offerings, and others.

Prerequisites: (MBA 6231, FINA 6213, FINA 6214) or (MBA 6231, FINA 6241)

Private equity has emerged as an important force in our financial markets. This course will explore current issues and best practices ranging from early-stage financing with angel investors and Venture Capital to late stage “take-private” transactions such as leveraged buyouts.

Prerequisites: (MBA 6231, FINA 6213, FINA 6214) or (MBA 6231, FINA 6241)

Early-stage financing is a critical success factor for growing businesses. This course will explore current issues and best practices for financing with public equity. Topics will include Initial Public Offerings (IPOs), Direct Listings and Special Purpose Acquisition Companies (SPAC) or Blank-check companies.

Prerequisite: MBA 6231

This one-credit class provides a unique opportunity to interact with local company CFOs. Two CFOs from different industries will be featured as guest speakers. Students will research and assess an industry sector and company from a strategic, operational, and financial perspective, as viewed through a CFO’s lens. Multiple assessment approaches will be explored depending on individual industry/company issues. Examples will include strategic assessment tools such as industry attractiveness and competitive advantage, value chain analysis, and financial assessment tools such as financial statement analysis, trend and ratio analysis and benchmarking. Students will need to demonstrate ability to gather, analyze and ultimately synthesize business recommendations.

Prerequisites: MBA 6231

This course explores financial options from the perspective of a corporation, including what financial options are, how they work, and how they are frequently used to pay employees and managers. Further applications will be explored, including how options can be used as tools to better understand corporate financing and project selection decisions.

Prerequisite: MBA 6231

This course examines financial decision making in multinational companies, including global debt and equity capital markets, international financial institutions, methods of financing international trade, capital budgeting for international projects, international risk analysis and portfolio diversification, linkages between national economies, and exchange rates.

Have questions?

Contact Full-Time MBA

| Contact Part-Time MBA

| Contact - Online MBA

|