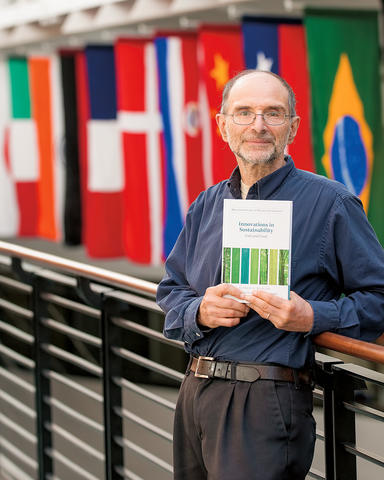

Faculty in 5: Alfred Marcus

Monday, October 10, 2016

Q: What is/are your current area(s) of research? What business challenges are you helping to solve?

A: My main interests are strategy and sustainability and my main focus has been on energy and food industries. A recently completed book on this topic, Innovations in Sustainability, won the 2016 outstanding book award at the Academy of Management ONE division. From a strategic perspective, companies in both the energy and food industries are at a crossroads. Fossil fuels never have been cheaper. Renewable energy and energy efficiency have made great progress. Technological change is occurring at a very rapid pace. Automobiles of the future will run increasingly on electricity. Driver-less vehicles are likely to become common. With services like Uber and car sharing, individual vehicle ownership may be less needed. As is the case of fossil fuels, the price of agricultural commodities like corn also has gone down. While about a quarter of the earth's 7 billion people still live at subsistence levels, another quarter suffer from surfeit and obesity.

In both sectors—energy and food—established companies face important strategic tensions. How are they going to assure their future growth and profitability given these changes in the external conditions that surround them? In both sectors, there are upstart new entrants with different business models. In autos, for example, Tesla is an outstanding instance of a company with a radically different business model. Nearly everything about Tesla is different, not just the drive train of the auto. Will Silicon Valley overtake Detroit as the center of the future U.S. auto industry and what repercussions with this have? To what extent must established industry players absorb the innovations introduced by upstarts, like Tesla? To what extent will the competition between the established players and the incumbents bring into existence entire new choices for consumers and at the same and perhaps more importantly transform the world? What will be the impact of this competition be on such important global issues as climate change, global security, energy independence, and so on? In my next book on the energy industry broadly conceived for which I have a contract from Cambridge U. Press I hope to grapple with some of these issues.

Q: What current business issues or stories in the news are you following and why?

A: I have written about and try to follow closely certain bell weather companies including oil giants like Exxon Mobil and BP, auto giants like GM and Toyota, and a host of food companies including General Mills, Kellogg's, Coke, Pepsi, Walmart, and Whole Foods. I am very interested in energy prices as they are both a cause and consequence of important global economic transformation including the move away from manufactured goods and toward services.

Agricultural productivity innovations also are of fundamental importance and in addition to following companies like Monsanto and DuPont I have written about and read voraciously about the GMO controversy. The epidemic of obesity and how the food companies have responded to it is of great interest. In my book Innovations in Sustainability I cover the role that venture capital has played in supporting start-up clean energy companies. While this role has diminished, I am still interested in technological developments as they affect various types of renewable energy such as solar and wind. Will there be a technological revolution in energy of similar magnitude to the technological revolution in IT that brought us the Internet and digitized the world? What will be the ultimate impact of the merging of innovations in digitization, energy, transportation, and food? We are in position where we can more closely monitor our activities via digital technologies, which is having a large effect on people's exercising and eating habits and has provided opportunities for companies like Fitbit. What is likely to come next in this realm?

Q: What is your favorite class to teach?

A: I teach both strategy and ethics, but as I joke to my students, not at the same time. But, in truth I love teaching them both and my aim is to bring together these two topics as best I can since I believe that corporations can make the world an infinitely better place and at the same time satisfy shareholder needs for higher returns, though accomplishing these two goals at the same time is not at all easy and takes all the cleverness, creativity, and imagination that an MBA education can bring to bear on a student's business career.

Q: If you weren’t a business school professor, what would you be doing?

A: Hopefully I would not be a cab driver since I have a woefully bad sense of direction (which is not very helpful in teaching strategy). I may have become a tort lawyer as I love the law and suffer from an abundance of righteous indignation. I may have become a professional do-gooder and worked for a global economic development agency. But more likely I would have become a journalist or historian since I love to find out what happened (usually not what we expected would have happened), love to try to figure why, and love to write about it. Or maybe I would have become a financial analyst and tried to figure out which firms had the best grasp of the future.

Q: What is the best book you’ve read in the past year?

A: Probably Daniel Yergin's The Quest on changes in the global energy industry. Although I recently completed Avi Shalem's My Promised Land and consider it to be an exceptionally moving and insightful work.